Purpose-Built

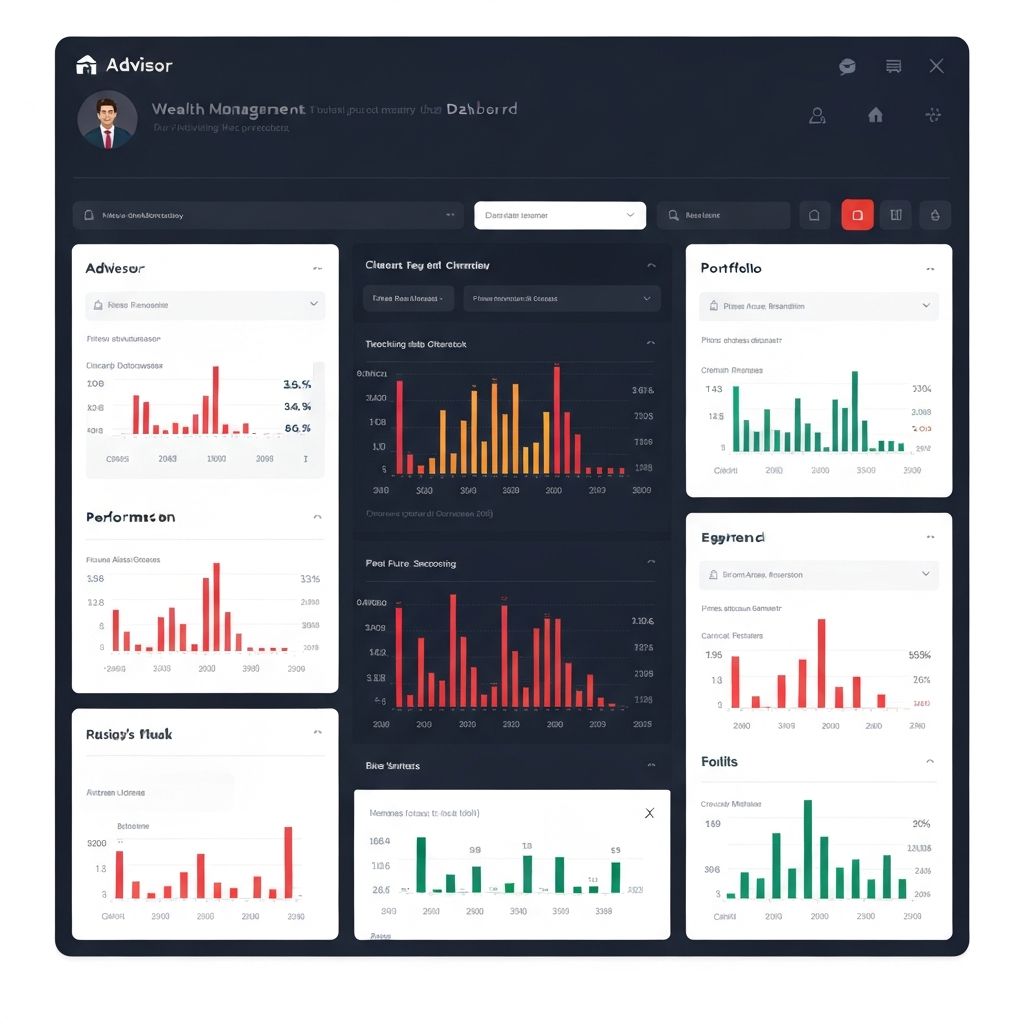

Purpose-built for wealth management workflows

Advisor & Client Operations

Automates advisor and client-facing operations

Enterprise Governance

Enterprise-grade governance and compliance

What Is the Wealth Management Agent?

The Wealth Management Agent is a domain-specific AI agent built to operate real wealth management processes.

It combines workflow automation, financial intelligence, and knowledge-driven reasoning to reduce advisor workload while improving client experience and operational consistency.

Core Workflow Areas

Pre-built workflows covering the full wealth management lifecycle

Client Onboarding & KYC

Automates client intake, documentation collection, regulatory checks, and initial engagement workflows.

Financial Planning & Advisory Support

Supports goal setting, scenario analysis, cash flow planning, and ongoing advisory interactions.

Investment & Portfolio Support

Assists with investment idea surfacing, portfolio rebalancing support, liquidity planning, and buy-sell decision context.

Client Reporting & Communication

Generates consistent reports, answers client queries on demand, and improves transparency across portfolios and performance.

Compliance & Risk Monitoring

Monitors risk profiles, detects policy breaches, maintains audit trails, and supports AML and suitability workflows.

How It Works

From data ingestion to governed execution

Ingest Client and Portfolio Context

The agent consumes data from CRM systems, portfolio platforms, documents, and historical interactions.

Execute Advisor and Client Workflows

Pre-built workflows coordinate onboarding, planning, reporting, and compliance tasks across systems.

Maintain Governance and Traceability

All actions, decisions, and outputs are logged, auditable, and governed within the operating fabric.

Business Impact

Measured outcomes from wealth management deployments

Faster client onboarding

Through automated intake and setup workflows

Reduction in advisor workload

By automating routine queries and reporting

Increase in lead-to-client conversion

With timely, personalized engagement

Increase in client engagement

Through continuous, AI-driven interactions

Faster compliance processing

With real-time checks and alerts

Reduction in operational costs

Achieved through end-to-end task automation

Why This Agent Works

The Wealth Management Agent is built on an enterprise AI platform designed for financial complexity. It combines domain-aware workflows, knowledge-backed reasoning, and operational controls to deliver reliable automation in regulated environments.

How Enterprises Use This Agent

Deploy As-Is

Accelerate time to value with production-ready workflows

Extend

Customize workflows and logic for firm-specific processes

Blueprint

Use as a foundation for building additional wealth or advisory agents

Ready to Transform Your Wealth Management Operations?

See how the Wealth Management Agent can automate your workflows while maintaining governance and compliance.